An Indian Summer

In a previous piece about Turkish current account balance, we said that we will let you know if anything changes in the basics of the mechanics and, well, this is going to be that. And boy what huge changes these are.

We also said this in our CPI analysis:

“We think CBRT has the means to keep the Lira on an extremely mild depreciation path”

So in this 2-in-1 bonus macro piece, we will connect these dots, analyze the prevailing current account dynamics, talk about the rapid rise in the foreign exchange reserves of CBRT briefly, and list our expectations for Turkish Balance of Payments figures in 2023.

Let’s get started.

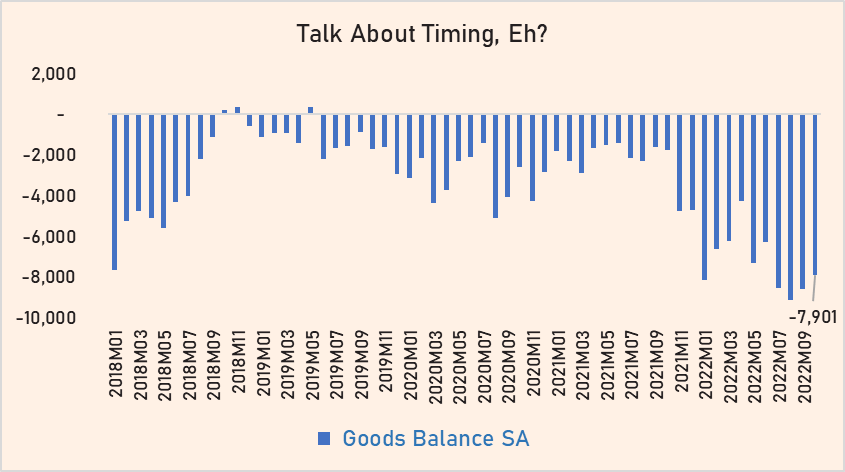

This week the Central Bank of the Republic of Turkey released the balance of payments statistics, and it was superb. The headline current account deficit figure came way below expectations and below even the most optimistic forecast, which was around $1 billion, and it was recorded as just $349 million. Some of this was because of your garden-variety seasonality. Current account deficits usually decline from September to October. However, even when we look at the seasonality-adjusted numbers, it is clear that there was a remarkable improvement in October of roughly $1.2 billion. So, even though the seasonality-adjusted current account deficit of $2.8 billion is still $2.8 billion more than what we would like Turkey to record, considering everything that is happening right now, it is a surprisingly positive result. And there were a few reasons that made this happen.

First and foremost, as we telegraphed loudly in our last current account article, energy prices declined significantly for both oil and gas, and this resulted in a noticeable improvement in the goods balance.

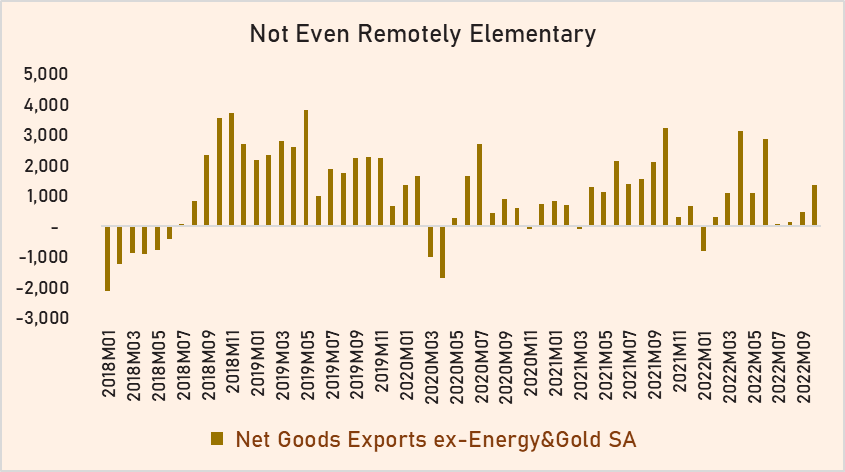

But even if we leave out energy and gold, there is still some improvement there.

We think that is partially because of the boom in capital goods exports, which is nice to see…

…and some compression in capital goods imports, which is not that nice, as this is a leading indicator of industrial production, and it has been weakening for a while. (However, the latest October figure was not that bad. There have been various divergences in industrial production coincident indicators lately like capacity utilization, PMI, SAMEKS, and Real Sector Confidence Index, so it’s a bit difficult to see where we are headed in that field, but this capital goods imports figure is another relatively bad sign for it.) The rest of the change in the Net Goods Exports ex-Energy and Gold came from price changes.

Another bad sign for the future is that, as thankfully flagged last time by Ertunc Aydogdu, because of the appreciation of the Lira in real terms (both inflation and income adjusted), consumption goods import volume rose significantly year-to-date, and we think this trend will continue after the wage hikes at the end of the year. In our previous article, we said we expected the minimum wage to be hiked to 8000 TL, which brings the real effective exchange rate by wages figure right back to where it was in 2017 and the sort of “breakeven” point of the USDTRY exchange rate where the 2019-2020 levels of REER can be had is around 21 TL/USD. We don’t think Lira will depreciate to that point as we wrote last week:

“[…] because the government apparently wants to lower the inflation as much as they can until the election while engaging in some election-spending and enacting some populist measures required to win the election, so they don’t want the impact of FX increasing the burden there, as it is abundantly clear from Minister Nebati’s latest speeches.”

The realization that the exchange rate will be kept stable was one of the key changes from our last current account report in this one. That’s why we assume a roughly 4-billion-dollar impact from the increase in consumption goods imports in 2023.

Another key change from the last report to this one is that tourism revenues recovered to where they were in August after a relatively surprising drop in seasonality-adjusted terms in September, because of exceptionally warm weather in October, and a rise in the per-tourist spending. The latter might have a thing or two with the better data compilation methodology for tourism data that was initiated recently. In the previous version of the methodology, the data was basically from a survey. In the revised one, CBRT uses a whole host of additional data like tourist credit card spending, etc. We can’t know for sure, but the drop in the Net Errors and Omissions from an average 2-billion-dollar inflows to just 660 million in October makes us think that this is the case. We expect a relatively strong figure for November as well in seasonality-adjusted terms in travel revenues. And both because the beginning of the year saw some residual impact of Covid so it was not until mid-Summer that foreign tourist arrivals caught up to their 2019 levels and because of the recent reopening in China, we expect the total net travel and net transportation revenues to be 10 billion dollars more in 2023 than 2022. (Though the latter factor accounts for only 500-750 million dollars of this forecast, it’s not nothing either.)

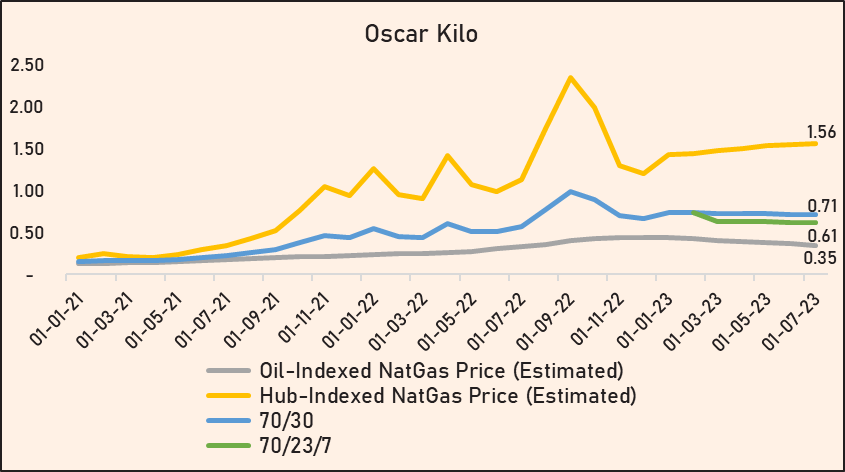

As we said above, we observed precipitous declines in both oil and gas prices in the last 3 months. Brent crude oil declined below 80 dollars…

…and Russian crude, which Turkey buys a lot of right now, thereby helping the global oil prices stay stable along with China and India, sells for steeper and steeper discounts.

We expect 2023 prices to average around their current levels except for some possibly chaotic period when Europe stops buying Russian diesel, which translates to around 16 billion dollars in gains for Turkey in 2023 compared to 2022 in crude oil and diesel imports alone. (You can check this piece for further details on Turkish crude and oil product imports.)

We expect natural gas prices to remain at their current high levels because as things stand right now, we think Europe will end this winter with about 20 percent of its natural gas inventory, so that means Europe will have to fill its inventory once again next year, but this time without Russian pipeline flows, which will be tough. We don’t expect prices to truly skyrocket like it did this year because of a very disorganized inventory filling period, but it will probably not be before 2026 that we will observe veritably normal natural gas prices.

However, thankfully Turkey imports around 70 percent of its natural gas via oil-indexed contracts, and once again, thankfully, oil prices declined significantly. Because of the 6-3-3 price structure in the oil-indexed contracts, (for more detail on this, please see our previous article on the current account balance) it will take a while for the decline in oil prices to passthrough to Turkish gas import prices but it will have an impact eventually and we estimate that effect to be nearly 2 billion dollars in 2023 compared to 2022. In March 2023, Turkey will start using its Black Sea natural gas and the initial production will cover about 6-7 percent of Turkey’s annual gas consumption. Because this will directly displace spot LNG imports, which is the most expensive type of natural gas Turkey imports right now, Black Sea gas will chip away 4.75 billion dollars from the natural gas import cost Turkey paid in 2022. All in all, we expect Turkey to pay 23 billion dollars less for energy in 2023.

[Noticed how the numbers regarding impacts were a lot smaller when we talked about huge and complex issues like competitiveness but they got much, much bigger when we started to list energy price-related effects?]

So in sum, we expect the 2023 current account deficit to be around 25 billion dollars.

If we breeze through the capital account (or the financial account as the cool kids call it nowadays), we forecast a net direct investment inflow of 7 billion dollars, and more than half of this will continue to be from real estate investments. That’s where the plateau seems to be in recent years. We are relatively pessimistic regarding portfolio flows and expect 9.5 billion dollars of net outflows, which is on par with the movement in 2020, as the Fed and other global central banks are holding onto their hawkish stances and it’s an election year in Turkey. And we expect 15 billion dollars of net inflows from other investments. The net inflows from this account amounted to 31.5 billion dollars year-to-date and 21.7 billion dollars in 2021, so once again we think this is relatively pessimistic. Last but not least, we reckon that we will observe roughly 5 billion dollars of net errors and omissions inflows. (12.6 billion dollars of net inflows were recorded in this account in the last 12 months.)

Our list of expectations so far puts the expected FX reserve decline at 7.5 billion dollars. Considering that the reserves are on a tear right now, there are a couple more bilateral deals in the pipeline with the likes of Saudi Arabia that would further bolster reserves, and that CDS is in decline, we think CBRT can keep the exchange rate stable if it wants to, in 2023, at least until the elections.

[Confusion Interlude: Recently there has been a lot of talk about the possibility of bilateral deals of CBRT coming with strings attached and being temporary. We found this perplexing. All money comes with strings attached. When some elderly blonde person residing in the White House threatened to collapse the Turkish economy 4 years ago, money that belonged to that country’s citizens and its allies left Turkey hastily and that money belonging to “people” rather than states did not change anything one bit. And as Jon Sindreu put it brilliantly in his latest piece, “Investors shouldn’t make the mistake of thinking such arrangements can’t last just because they aren’t market-based”]

We’d strongly prefer that they chose to accumulate some more reserves that would help lower CDS further while helping with the competitiveness of the Turkish economy, but as we said in our last article, that does not seem to be the approach the government will be taking.

Absolutely Essential Disclaimer: As any forecaster who publicly releases his/her forecasts knows, this is a thankless job, as the odds of your forecast turning out to be completely accurate are infinitesimal. One accepts this reality and moves on. However, we have to make something clear, not to cover our rears but to situate this whole piece properly: This is our baseline forecast. That means we think it is the likely path the future will take. It does not mean that it’s the only path the future can take. There are paths that force CBRT’s hand significantly and there are paths that help it accumulate a staggering amount of reserves in 2023. One such path is if Russia accepts Turkey’s proposal to apply a discount of 25 percent for its natural gas exports and postpone the payments to 2024. This is certainly possible, but it is not in our baseline forecast because we think it’s not a part of the “most likely trajectory of future events."