Turkish Current Account Balance – An Update

Yesterday Central Bank of the Republic of Turkey (CBRT) released the September balance of payments figures and Turkey had a current account deficit of 2.97 billion dollars. We seasonally adjusted the figures to be able to better understand the month-to-month trend and it seems the spectacular rise in the transportation revenues continued in September as well, which increased by a respectable 14.6 percent annualized month-to-month. (This is abundantly clear from the recent Q3 results of Turkish Airlines, which is possibly the most profitable flag carrier airline in the world right now. It had 1.5 billion dollars of net income in just the third quarter of 2022).

Source: Galata Chronicles’ calculations, CBRT (Last Observation: September 2022)

Eurocontrol data suggests that this remarkable performance in air travel continued, nay, got even stronger in October and November, so we might expect further increases in seasonally adjusted transportation revenues in the upcoming BoP releases. The chart below from Eurocontrol shows the daily number of flights into/from Turkey and compares them to the 2019 levels.

Source: Eurocontrol

Meanwhile, net travel revenues seem to have stopped its rapid ascension for now and declined by roughly 500 million dollars compared to the August results (seasonally adjusted), which was mainly due to the decrease in the number of tourists while the per-tourist revenue was flat. And the General Directorate of State Airports Authority (DHMI) figures for October suggest that the relatively underwhelming, but still above the all-time highs, travel revenue trend continued in October as well. Some more hopeful news came from Antalya, and we learned that tourist inflows to Antalya stood at an all-time high in October, so perhaps we’ll observe a better October travel revenue figure in the BoP than DHMI numbers suggest. But it is probably not a stretch to say that the 5-6 month breathtakingly good episode of Turkey adding more than 5 percent month-to-month to its seasonally adjusted tourism revenues ended for now.

Source: Galata Chronicles’ calculations, CBRT (Last Observation: September 2022)

In sum, the evergreen story of Turkey funding its goods deficit with its services surplus continued in September. And about that goods deficit:

Source: Galata Chronicles’ calculations, CBRT (Last Observation: September 2022)

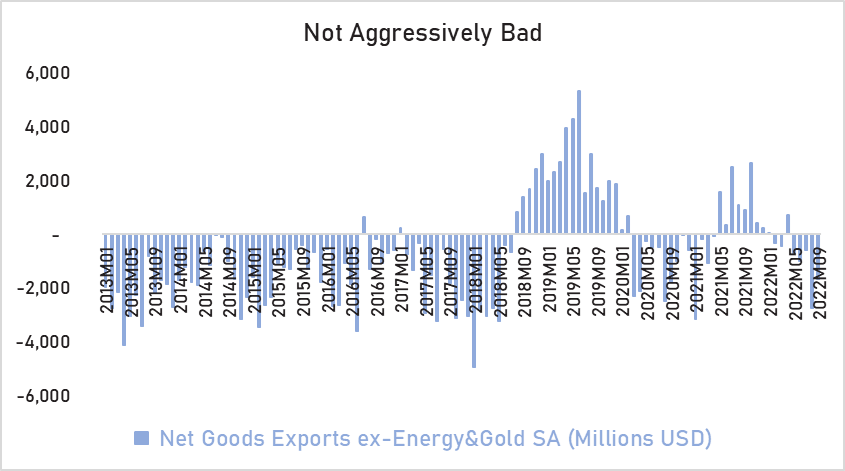

OK, that looks pretty bad. But if you have been reading us for a few weeks now, you should be asking “Sure that looks bad, but remember, Turkey is an energy importer, energy prices are at an all-time high, so what’s the picture if you remove energy imports?”. Well, excellent question, dear reader. We will do you one better and remove net gold imports as well, to see how things are going in the “core” goods account. It turns out that it’s not nearly as bad as the chart above, but it’s not great either. Even if you remove gold and energy, there is a clear worsening in the core trend.

Source: Galata Chronicles’ calculations, CBRT (Last Observation: September 2022)

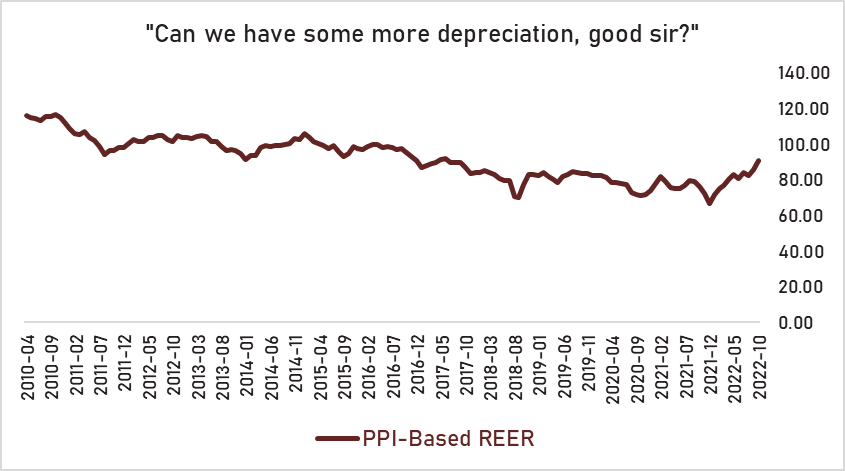

The main issue seems to be, because the exchange rate is relatively stable while there is a huge amount of price inflation, Turkish exports see their competitiveness erode. The chart below shows that the PPI-based Real Effective Exchange Rate is nearly back to its 2017 levels, because of the stratospheric rise in the PPI, which we don’t forecast to keep on going in 2023, so perhaps the usual path of depreciation in the Lira in the next 1.5 years will provide some respite here to the tune of roughly 7-8 points. One other potential problem is, Turkish exporters benefited a lot from the skyrocketing freight prices in the last year or two, but freight prices are collapsing globally, so it remains to be seen if they can keep the markets they gained in this period.

Source: CBRT (Last Observation: October 2022)

We have to note that the picture in the CPI-based REER is a lot different, and the level is stagnant for quite a while, so we expect the depressed levels of consumer goods import to continue for the near future, though the wage hikes at the end of this year might be a tailwind there. Despite all this, Turkey has roughly 2-3 billion dollars of ex-energy and gold seasonally adjusted current account surplus, and if energy prices stayed at their 2021 levels, Turkey would still be enjoying a current account surplus on average. That means we need to look at the more unstable part, which unfortunately constitutes a large chunk of the Turkish BoP picture: Energy. (We know we shared this chart in a previous article but it wouldn’t hurt to save you a click, would it?)

Source: Galata Chronicles’ calculations

Let’s get oil out of the way first, because we talked about it in depth in our last macro article: because of the Urals discount, we expect that the price Turkey pays for its oil imports will stay largely stagnant for the next 4-5 months, as we expect the discount to balance the impact of the higher diesel prices to a large extent, since the more effective the EU price cap and import ban, the higher the European diesel prices but lower the Russian oil prices. (Probably)

That leaves natural gas. The good news is, Turkish natural gas imports are at the lower edge of the last 3-4 year consumption patterns.

Source: Galata Chronicles’ calculations, EXIST (Last Observation: October 2022)

There are two reasons behind that. The first one is temperatures. Turkey, like Europe, has seen temperatures 2-3 degrees above the seasonal averages. Our estimates show that a single degree makes a difference of about 100 million cubic meters, though this is not a constant figure, and the colder it gets, the better it is to have warmer than average temperatures. The chart below specifies this. And the latest meteorological forecasts show that the weather in Turkey will continue to help, with 1.5-2 degrees above normal temperatures in the next three months. (And the second reason, probably, is that natural gas prices increased 4-fold year-over-year for residential use, which constitutes the bulk of the seasonal variation in natural gas consumption, so there is a huge amount of price incentive to just wear a sweater inside the house and not consume gas as usual.)

Source: Galata Chronicles’ calculations

The second and obviously the more important component of the natural gas BoP picture is price. A couple of facts: Turkey gets roughly 70 percent of its natural gas with oil-indexed prices and the remaining part from hub-indexed ones, like spot LNG. (Actually, the oil-indexed share was higher until this year, but in January Turkey renewed a gas supply deal with Russia for about a quarter of its imports from Russia but switched from oil-indexation to hub-indexation, and if it didn’t it would have paid roughly 3 billion dollars less for gas year-to-date. Turkey for years wanted to switch to hub-indexation because gas-to-gas competition forced LNG to be a lot cheaper, especially in 2020, but right when it got what it wanted, Russia-Ukraine War happened, and well, you know the rest of the story. Talk about fate.) There is literally nothing publicly known about Turkish natural gas supply contracts except if they are oil or hub-indexed, but we at Galata Chronicles are a curious bunch so we spent days and days econometrically analyzing the available data and our conclusion is, Turkish oil-indexed gas import prices are roughly 30 percent of the 6-3-3 heating oil prices and hub-indexed prices are on average 94 percent of the TTF prices on a per-M3 basis. (6-3-3 is a gas market term and it basically means a rolling 6-month average with a 3-month lag. In the chart below you see our forecast for the Turkish natural gas import prices and a 70/30 percent weighted average for an indication of the total path. As it can be seen, import prices quite likely peaked in September and October, and thanks to the good weather in Europe that helped collapse TTF prices along with full natural gas inventories, Turkey will pay roughly 30 percent less for its natural gas in November compared to the September-October average.

Source: Galata Chronicles’ calculations, Bloomberg

So overall, the energy part of the balance of payments equation will probably be a lot better in the next couple of months. That leaves gold and we prefer to not say a lot here because when we do, it usually contains a ton of expletives about the mind-boggling nature of still buying this much gold in 2022, so let’s just say Turkish people are on average hardcore goldbugs and we don’t expect significant positive news from this front anytime soon. Istanbul Gold Refinery data shows the amount of imports didn’t change much compared to September in October 2022.

Source: Galata Chronicles’ calculations, CBRT (Last Observation: September 2022)

In conclusion, while there are significant headwinds for Turkish exporters and energy prices continue to severely impact things, because of the still strong services exports and lower natural gas prices, we think the worst might be behind us in terms of the current account balance. At least for the next couple of months. If anything changes here, we will let you know.

Disclaimer:

The articles on this website are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.