Retailers Can Survive Better!

Hello, everyone. Welcome to our new markets post. We should emphasize that the next year will be interesting in many respects. Amidst local and global macro uncertainties, there will be an election in Turkey that has the potential to change the course of literally everything. Some sectors may benefit from the election environment, while others may not. We should be quite selective about the stocks and watchful for possible watershed moments in the macro environment.

In this post, we want to make some highlights about the textiles and ready-to-wear sector (considering the aforementioned dynamics). Then, we will look at why Mavi Giyim (MAVI) has attracted our attention.

Producers vs. Retailers

We can classify the companies in the textile and ready-to-wear sector as i) producers/manufacturers, and ii) retailers. There are significantly different dynamics for these two types of companies, and it is quite important to take these different dynamics into the consideration when making investment decisions. To put our view forward first, in the coming period, we think that retailers will be in a more advantageous position than manufacturers/producers.

Here are our reasons:

One of the main differences is that while the producers/manufacturers in the textile and ready-to-wear sector are mostly export-dependent (it produces above the needs of the domestic market, so they need the positive outlook abroad), retailers (such as MAVI, and VAKKO) are overwhelmingly selling to the domestic market. Under current conditions, which side has more advantages? To understand, we can look at two different data.

Firstly, if we look at the exports of textile and ready-to-wear companies, it is obviously losing momentum.

The problems in economic activity in Europe (the biggest trade partner, for textiles, its share is around 44%) are quite harmful for such a sector that produces above the needs of the domestic market.

In addition to the negative economic outlook in European countries, as we emphasized in our last macro post, because the exchange rate is relatively stable in the recent period, while there is a huge amount of price inflation in Turkey, the competitiveness of Turkish exports eroded to some degree. The PPI-based Real Effective Exchange Rate exceeded the level of 90 for the first time since June 2017. We have mixed thoughts and feelings about that rise because we cannot predict how long it will remain at these elevated levels while entering the election year (the clear focus of policymakers on inflation and USDTRY). We cannot predict how long it takes to make a balance between inflation/FX rates, and the current account balance dynamics. There is a clear choice about exchange rates now. Some respite in REER may be needed.

(From our last macro post)

According to news from sectoral sources, in the textile and ready-to-wear sector, large buyers turned to other regions for supply instead of Turkey because of rising costs. A decrease in freight cost is also important in that respect. According to that news, Inditex, the owner of the world's largest fast fashion brands stated that it will increase its purchases from Asia and reduce from Turkey. Industry representatives stated that the imports are now becoming more attractive even for local brands such as LC Waikiki, DeFacto, and Koton.

Another important development is that the ban on Uzbekistan cotton which has been implemented by more than 300 global brands since 2011, was lifted as of March 2022. Uzbekistan has been boycotted since 2011 by famous brands such as H&M, Adidas, and Marks & Spencer, due to poor cotton production conditions and child labor usage. However, with the reforms made in the country, the cotton export ban was finally lifted. Why is it important? It means that the world's sixth-largest cotton producer will return. It once ranked as the second country in cotton exports. The return of Uzbekistan facilitates the country’s textile sector-oriented growth strategy. It is stated that the country’s aim is to turn from a cotton producer into a textile and clothing exporter country. Reportedly, new textile manufacturing sites were established in the country in the last few years. As of September, the import of cotton, cotton yarn, and cotton textiles of Turkey increased by 55% YoY in USD terms (exports increased by just 5 percent). The return of Uzbekistan affected it as well. The foreign trade deficit in the yarn category and the falling capacity utilization rates in that category increased the concerns. While the return of Uzbekistan will increase the supply of cotton-made intermediary products in the world, please consider the PPI-based real effective exchange rate in Turkey. Alerts for Turkish yarn producers.

Therefore, to conclude, the overall outlook for producers/manufacturers in that sector seems mixed, and a bit negative.

Secondly, let’s look at the retail side. CBRT published the debit & credit card expenditure data for the week ending 11th November.

As you can see, the clothing & accessory category posted strong growth YoY in USD terms last week. It even gained momentum recently. From the longer time horizon (52-week) to the shorter one (the last week), it seems this category has a healthy growth this year. This data shows that the domestic demand for ready-to-wear retailers is strong. Well, what should we expect? We think that this positive momentum will continue, if not increase.

i) People in Turkey still think that the high inflation environment will persist for a while (even if the base effect will kick to some degree, CPI will only slide down to the low 40s YoY). They try to front-load their demands right now. On the other hand, compared to durable goods such as white goods or furniture, ready-to-wear items are more affordable under these conditions.

ii) We expect that the minimum wage will be increased substantially in 2023 before the elections. It will increase the appetite for more shopping. It will return more sales for the retailers.

iii) The outlook in export markets is less relevant for Turkish ready-to-wear retailers because they are less export-dependent compared to the producers.

To conclude, we are more optimistic about retailers in the coming period under current conditions.

Mavi Giyim (MAVI) Has Tailwinds

If you have been following Turkish markets, you are familiar with Mavi Giyim (MAVI). Mavi Giyim was established in 1991 in Istanbul as a denim-centric ready-to-wear company and has been publicly traded since 2017 in Borsa Istanbul. Mavi’s line of business includes the wholesale and retail sales of ready-to-wear apparel to customers. The company does not engage in any production activity. Its diversified supplier network manufactures the products and makes them ready for sale. This supplier network includes more than 120 main suppliers and 485 sub-suppliers (80% of them located in Turkey). In the production process, the apparel’s design & development phase is directly performed by Mavi itself. In addition, the selection of fabric & raw materials is controlled by the company. After these processes, the phase of production (cutting, sewing, and washing) is delegated to the manufacturers.

Without going into more details about the company, we would like to draw attention to a few points that can be important in the coming period.

As we see in the credit and debit card expenditure data published by CBRT, the outlook for the clothing category is quite positive right now, and we think that Mavi Giyim can capture these positive dynamics. The company has a unique brand image in the denim category. According to the survey results of Marketing Türkiye Magazine, in the denim category, MAVI is a top choice in the preference ranking of different generations. The magazine stated that there is no competition in denim, there is a strong leader.

The share of exports in the company’s total sales is below 20 percent. All the aforementioned headwinds in the export markets have limited impacts on the company’s financials. The momentum is positive in the domestic market. Moreover, the company can offset the negative outlook in export markets to some extent with its strong brand image.

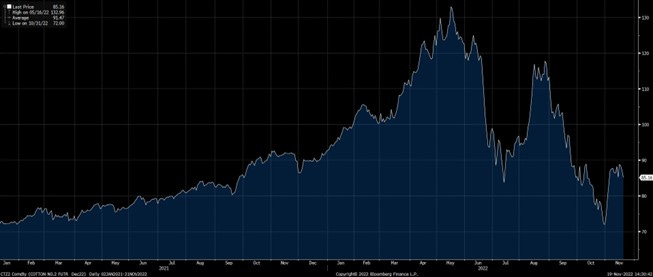

As the CEO of the company stated in the first quarter financial results webcast, the price of cotton is quite important for the company. The margins are more dependent on the prices of cotton and fabric (rather than wage increases, therefore, the impact of a high minimum wage increase may be limited).

(From the earnings call transcript of 1Q22)

From its peak in May 2022, cotton prices started to decline. It's still 36 percent below that level. It will affect MAVI’s COGS and gross profit margin. But, again, as the CEO said, there is around a six-month lag in terms of cost reflection. We will see the impact of that decline in the last quarter of 2022 (slightly), and the first quarter of 2023 (especially here).

(Bloomberg)

We expect that the substantial increase in minimum wages will further drive consumption up in Turkey, which is positive for MAVI. We also expect that the high consumer demand will result in very high sell-through rates and lower markdowns, as in 1Q 2022. Lower markdowns will support the margins.

NOTE: Typically, fall-winter products have lower gross margins by design. They are more import-dependent, and they are less made in Turkey. Because of that, the management team of the company was more pessimistic about that period (seen in transcripts). Therefore, normally, it is appropriate to expect lower gross margins in the last and first quarters. However, this time, the impact of lower markdowns (if happened) will support the margins. All in all, there could be slight margin erosions.

To conclude, the macro environment seems to be positive for ready-to-wear retailers, compared to the producers. MAVI is one of them and is a powerful player in its segment. It will announce its third-quarter result on 12th December. Our revenue forecast is the following:

We did not value the company here but we can say that Mavi Giyim has clear tailwinds.

Disclaimer:

The articles on this website are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.