Potpourri

Hello everyone, before we go on with our regular programming, we wanted to catch up a few data releases, and developments.

Once again, we send our condolences to the relatives of those who lost their lives and to the whole nation. We wish healing to the injured ones. As Galata Chronicles, we thought it would be appropriate to wait for some time to talk about issues other than the earthquake and its tragic consequences because people’s priorities in our country were far from normal times. Our hearts go out to everyone affected by the earthquake. It will be very difficult for us to return to normal life and our daily agendas.

Instead of a thematic post today, we will take a brief look at some data that has been published since our last markets post. These are sectoral export data, consumption goods imports, PMI data, and credit/debit card expenditures. A few points will follow.

Sectoral Export Data

The Turkish Exporters Assembly (TİM) has published the export data for January and February.

In January, we see that the leather and leather products, automotive, electric electronics, and cereals-legumes sectors increased their exports strongly on an annual basis. On the other hand, the steel, defense and aerospace, and fruit and vegetable products sectors showed a negative performance in terms of exports in that month. In February, with the negative impact of the earthquake, the exports of many sectors slowed down on an annual basis. The Ministry of Commerce announced that the earthquake affected the headline export in February by 1.5 billion dollars negatively (this is the direct impact). Total exports in the month amounted to 18.6 billion dollars. In both January and February, electric electronics performed quite well on an annual basis. On the other hand, the poor performance of the steel sector continued this year.

Consumption Goods Import

Because of the fact that the Lira appreciated in real terms recently (both inflation and income-adjusted), consumption goods import volume rose significantly in 2022. We think that this situation will continue if the flattened course in the USDTRY continues. People buy imported goods they need when the Lira is relatively strong compared to the last few years. This situation seems likely to continue at least until the elections. Companies that sell imported products (distributors like TKNSA or DOAS) can take advantage of this situation in terms of sales growth.

PMI Data

The headline PMI realized as 50.1 in February, unchanged from the previous month. However, the primary reason behind the above-threshold headline data is the rising delivery times of the suppliers, hugely affected by the earthquake. The delivery times of the suppliers are inverted in that calculation.

The effects of the earthquake can be observed in almost every data because of its widespread destruction. Ten provinces have been affected by the earthquake. According to JP Morgan Research, they correspond to 9.3% of Turkey’s GDP, 8.5% of exports, 5.0% of tax revenues, and 11.1% of active employees. The three worst-affected provinces (Hatay, Adiyaman, and Kahramanmaras) account for 2.6% of GDP, 2.2% of exports, and 2.3% of tax revenues.

The earthquake in Turkey affected a very large area. The maps below, published by Reuters, show the size of the ruptures relative to other well-known lands. It is massive!

According to sectoral manufacturing PMI data, four out of ten sectors were in the growth zone, while six remained in the contraction zone in February. The earthquake affected all sectors of the Turkish manufacturing industry to a certain extent. The destruction and chaos caused by the earthquake affected the production level and supply chains. Delivery times significantly increased in some sectors. The production level decreased in nine out of ten sectors.

Among the sectors, chemicals, basic metals, vehicles, and machinery were the ones that performed positively. Textiles, clothing, and food products showed the most negative performances.

Credit/Debit Card Expenditures

According to the credit/debit card expenditure data announced by the CBRT, the categories with the highest annual growth in the last 4-week period were insurance, contractor services, car rental, and associations & social services. Aids made to non-governmental organizations due to the earthquake was the primary reason behind the growth in the social services and associations category.

In the same period, airlines became the worst-performing category. Evidently, airline companies use their capacity for international flights more and more due to the decrease in domestic purchasing power and price ceilings. International passenger traffic will be a more important indicator for the companies' financials.

Exceptionally Good

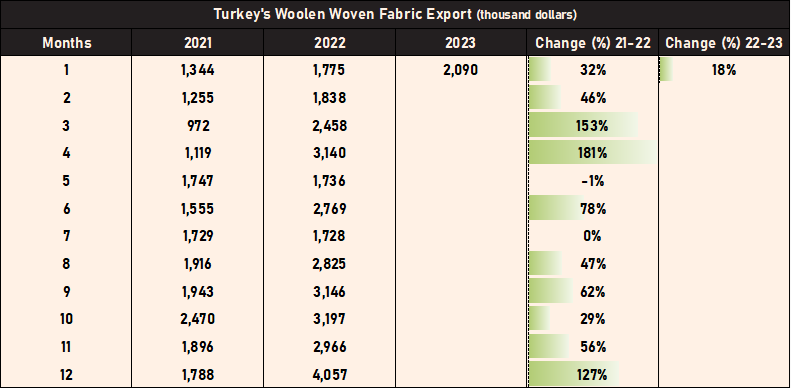

We have often pointed out that macro conditions are challenging for some exporters due to the appreciation of PPI-based real effective exchange rate and the slowdown in economic activity in most export markets. However, we also believe that companies that produce value-added products can still perform well, especially in terms of sales growth. One such company is YUNSA, which produces woolen woven fabric, a high-value-added branch of the fabric industry. YUNSA accounts for 70% of Turkey’s woolen woven fabric exports and meets about 5% of the world’s woolen fabric market, making it a strong player in this niche segment. Woolen woven fabric export data, which is a leading indicator for YUNSA’s sales, showed positive YoY growth in dollar terms in November and December last year, and this trend continued in January this year.

The Headwind for Mavi Giyim (MAVI)

We did detailed research on Mavi Giyim (MAVI) before. While we think Mavi still has strong financials, we would like to point out a headwind. Approximately 80 percent of Mavi's costs are in TRY terms, and it has TRY-based product pricing. Mavi's multinational competitors generally use FX-based pricing. In times when the exchange rate rises sharply, Mavi’s TRY-based product pricing allows it to offer competitive prices and gain market share. However, the exchange rate has been following a flat course for a while, and costs in TRY terms have increased significantly. This is a clear headwind for Mavi's price competitiveness and market share gains. Please take it into consideration.

Disclaimer:

The articles on this website are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.