All Quiet on The Western Front

Welcome to our new markets post. There are a lot of data releases this week. We will go over some of them today briefly. We can say that it is all quiet on the western front. Domestic consumption continues its strong course. It highlights companies that sell to the end-consumer. However, PMI data indicates that alarm bells are ringing for some sectors. Export data shows that lower demand in export markets and declining competitiveness continue to challenge exporters. Last but not least, Tupras continues to enjoy high margins. Let's dig deeper.

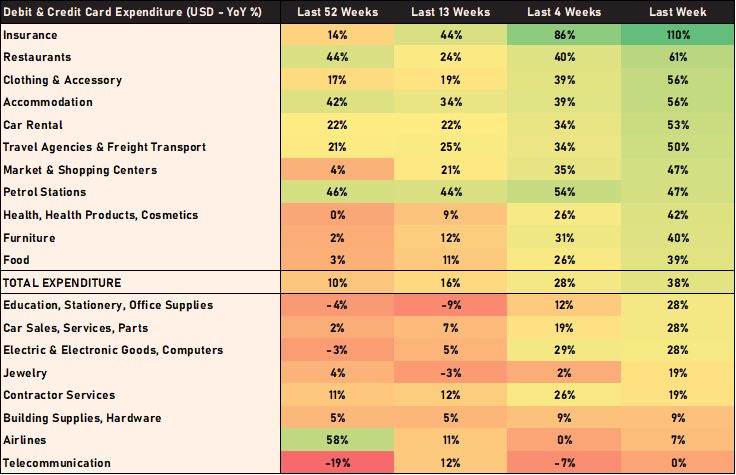

Debit & Credit Card Expenditures

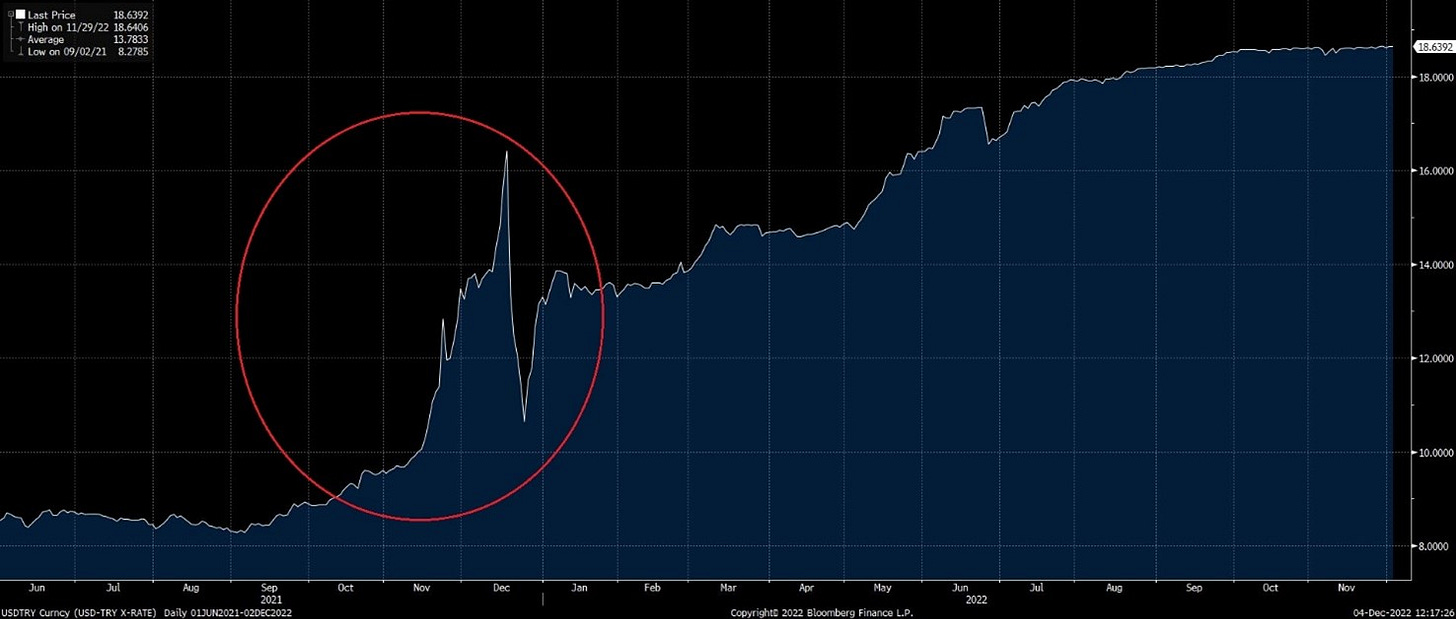

We think that tracking credit card data in dollar terms is important for more accurate comparisons. However, one year ago during this period, there was mind-boggling volatility in the USDTRY exchange rate. Therefore, for at least these couple of weeks it is better to focus on which sectors are doing better than others, rather than the level of change but in general, it is obvious that domestic consumption continues its strong course.

For those who don't understand what we mean by “mind-boggling”, the chart of the USDTRY rate is the following:

From Bloomberg

One month implied volatility for USDTRY:

From Bloomberg

If we look at the credit card data, we see that insurance, restaurants, clothing, and accommodation expenditures are strong. We explained our views on clothing expenditures in detail in our previous markets post. Moreover, we think that discount campaigns in November supported household spending in some categories like clothing. We are eagerly awaiting the third quarter results of Mavi Giyim, which will be announced on 12 December.

Sectoral Export Data

Turkish Exporters Assembly (TİM) announced the sectoral export data for November. We look at the annual changes in some sectors we chose.

Source: Turkish Exporters Assembly (TİM)

Fruit and vegetable products maintained their positive momentum despite the slight slowdown monthly. Looking at the sub-categories, we see a strong increase in the export of canned products (+37% YoY). We estimate that the positive trend in tomato paste exports continues in November. In addition to the tonnage growth, the unit value of tomato paste has shown a very strong increase in the recent period. (The value per ton, which was 1090 dollars at the beginning of the year, approached the 1900 dollars level in October.) This data is positive for tomato paste producers such as TATGD and TUKAS.

Source: Turkstat

The textile category continued to remain in the contraction zone this month. Looking at the sub-categories, the largest decline was observed in the yarn category (-19% YoY) which affects the headline the most. We have drawn attention to some potential risks for yarn producers in our previous markets post.

Steel exports drastically declined amid rising costs and weak demand. It becomes apparent that the growth in the chemicals category began to slow down.

Leather and automotive categories gained positive momentum this month.

In the first 11 months of the year, exports increased by 14% compared to the same period last year, while exports increased by 2% on an annual basis in November. We can say that lower demand in export markets and declining competitiveness will continue to challenge exporters despite some sectors posting strong growths. We should be quite selective when talking about the exporters.

PMI Data

The headline PMI fell to 45.7 in November and remained below the threshold of 50 for the ninth month in a row. In line with our expectations and other data releases, many sectors are in the contraction zone in November. Textile and steel have long been below the threshold. Clothing, on the other hand, has a positive outlook here as well.

Source: Istanbul Chamber of Industry (ISO)

Weekly electricity generation data (MWh), which is the leading indicator for economic activity, is also not very good in recent weeks compared to last year.

Source: CBRT

TUPRAS’s November Margins

This week, TUPRAS’s margins (Turkish refinery) were announced. In one of our previous posts, we made evaluations on petroleum products and especially on the diesel market in Turkey. Diesel margins are particularly important for the company due to the high share of diesel in the company's sales. Although the company's diesel margins fell on a monthly basis, they remained well above their historical averages.

From Tupras’ investor presentation

We should say that these times are quite exceptional for this market and these margins cannot last for years. Our humble perspective is that no one should invest on the assumption that these margins will last forever. Consider the margin cycles, please. Some caveats should be made even for long-term investors. Where are we in the margins cycle? Not anywhere near the bottom for sure.

Our question is that how long can margins stay at these high levels in the global diesel market? What developments should we monitor?

i) Russian Sanctions and European Needs: Some of the diesel supplied by Russia disappeared from the market in 2022. Furthermore, the EU will ban Russian oil product imports (including diesel) by February 5. Where this ban will evolve and to what extent other regions will be able to compensate for the deficit will be important. Before the ban, Russian diesel loadings going to the Amsterdam-Rotterdam-Antwerp (ARA) storage site increased by 126% in the first 12 days of November, compared to the previous month. EU diesel imports from non-Europe/non-Russian sources increased substantially. Europe is more likely to be ready for the sanctions than we think. At the start of the year, there were estimates of additional diesel demand from Europe for heat and electricity generation. Nothing significant materialized so far. Economic slowdown and weather conditions helped a lot. We will monitor how weather conditions and sanctions on Russia will affect the market for Europe. Economic activity will be also important for the demand conditions.

ii) Chinese Refineries: China has considerably reduced its exports of petroleum products in 2022. This has reduced the global diesel supply. However, recently, there have been reports that refineries in China have increased diesel exports to profit from robust margins. If this situation continues strongly, it may have positive effects in terms of supply, especially in the East-of-Suez. It will help to boost East-of-Suez flows to Europe (indirectly) because, in the absence of Chinese products, East-of-Suez flows should go further east to some extent (at the expense of supply for Europeans).

iii) Gas Crisis: If you know the distillation process in general, you know that the crude quality used in the process is quite important for the refining results. This year, higher natural gas costs created incentives for more usage of sweeter crude oil. To reduce their natural gas usage, the refineries preferred light sweet crudes that require less desulfurization. Light crude oil yields more gasoline but less middle distillates. This reduced diesel output and increased its cracks. It also increased gasoline output and decreased gasoline cracks. It will be important whether there will be a change or not on this front in the upcoming period.

From U.S. Energy Information Administration

Based on these factors, it is a probability that we can see a further increase in margins, or it will remain at these elevated levels for some time but we think that the probability for the opposite scenario should not be underestimated, especially for the first half of 2023.

Disclaimer:

The articles on this website are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.