Tremendous Pricing Power, Until When?: The Case of Doğuş Otomotiv (DOAS)

Hello, welcome to our new markets post. This week, we will look at the automotive sector, specifically Doğuş Otomotiv (DOAS). The automotive industry is a sector that has been talked about a lot since the pandemic period. We've all read a lot about microchips that are small in size and critical in importance. With the semiconductor crisis, serious production disruptions occurred, especially in the automotive and consumer electronics sectors. Manufacturers and distributors in the automotive sector were not affected in the exact same way and with the same intensity. There were/are different dynamics. In addition, many country-specific dynamics have emerged in recent years that have affected the automotive industry in Turkey. In this article, we will examine the positive and negative sectoral dynamics as much as possible from the perspective of DOAS.

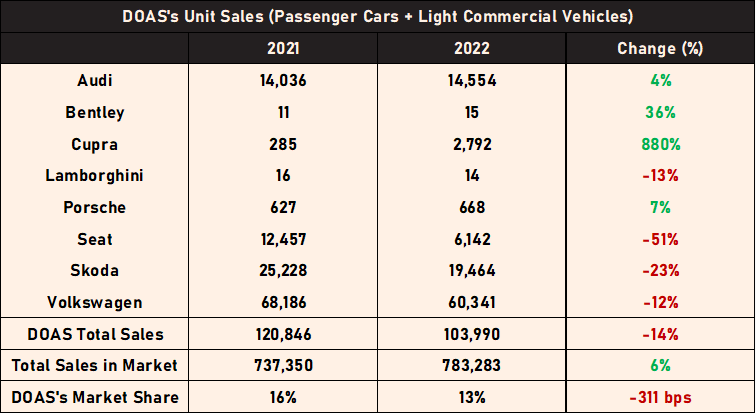

Doğuş Otomotiv (DOAS) is an automotive importer and one of the largest distributors, operating in Turkey. The company has wide networks in the country that enables a strong market position. The company offers a diverse product portfolio consisting of Audi, Bentley, Cupra, Lamborghini, Porsche, Seat, Škoda, Scania, and Volkswagen (both VW passenger cars, and commercial vehicles). In addition, the company offers some services like vehicle inspection, marine services, second-hand vehicle sales, insurance, auto lending, etc. As a pure importer, the company differs from other publicly traded companies in Borsa Istanbul. The significant difference is that the company is fully exposed to the risk of Turkey, which brings advantages and disadvantages from time to time.

Let’s look at the domestic market briefly. In 2022, we saw that the demand for automotive (specifically, passenger cars [PC], and light commercial vehicles [LCV]) is relatively strong in terms of units sold in the Turkish market, indicating a 6 percent YoY growth, although it is below the ten-year average, according to the Automotive Distributors and Mobility Association (ADMA). If vehicle availability had been high last year, it could probably have exceeded the ten-year average.

We think that buying a car has become an important investment tool (rather than consumption) for people in an environment of high inflation and low-interest rates. This dynamic supported the demand in the market. Evidently, people bought cars with low interest-rate auto loans, compared to the inflation rate. This was also reflected in the vehicle financing growth, according to the data published by Banking Regulation and Supervision Agency (BRSA). The 13-week annualized momentum picked up quickly (the data also includes second-hand auto loans) (as of the week of 20th January). On the other hand, due to the skyrocketing prices in the housing market, automobiles have also started to attract attention as a more attainable investment tool.

As another indicator, the share of vehicle loans in total consumer loans increased meaningfully. In this case, another factor as important as consumer demand was the wider spread in vehicle loans, compared to other loan types, which incentivize the lender banks. Due to the measures taken by the CBRT, the spread seems to have disappeared in commercial loans for the banks right now. However, vehicle loans became the type of loan with the highest spread (7 points) after personal loans. These spreads are calculated by subtracting the weighted average deposit interest rate from the relevant loan rate (both are flow data).

In addition to the high demand environment for automobiles, fueled by the reasons we mentioned above, the chip crisis and the rapid depreciation of the Turkish Lira caused sharp increases in automotive prices in the last years. The supply-demand imbalance has reduced vehicle availability in the market, pushing the prices up. Due to the problems about vehicle availability, there is probably a significant pent-up demand left-over from 2022. The fact that vehicle sales have remained below the long-term average for the last 5 years also raises expectations for the coming years. There are reports stating that “more chips will become available in the second half of 2022 and the shortage is nearing the end”. However, “capacity still needs to be qualified for use in the automotive industry. Can the right matching occur between available supply and correct qualification? This is the difficulty that remains.”. So it is possible that these chips may not be the right type to satisfy automotive makers’ demands. As we understand it, even in the optimistic scenario, we should not expect the chip crisis to be fully solved before the end of 2023. Some reports talk about a period of a few years. The course of developments keeps its uncertainty.

Now let's get to know DOAS better and see how things are going for the company. In 2022, DOAS’s sales in terms of units decreased from 120,846 to 103,900, indicating a 14 percent decrease, according to Automotive Distributors and Mobility Association (ADMA).

One of the most important features for DOAS in recent years has been the decrease in vehicle availability. Despite the decrease in sales in terms of quantity, the company achieved quite high revenues, profits, and historically high-profit margins with the advantage of being the sole authorized distributor for important brands. In the chart below, you can see the company's gross profit margin and EBITDA margin, which were at their historical peaks. No doubt, this is a seller's market. Almost, the company sells its products as soon as they come off the production line. The company has sold products at pretty good margins without the usual discounts. Similarly, it probably had to spend much less on advertising and related expenses than before (cost advantage). Additionally, according to the information we received from the sector, being able to choose who will be the buyer (seller's market) was also a very important factor on the margins (option to prefer high-margin consumer types). We can expect the continuation of high margins until the chip crisis is over. It is obvious that the chip crisis has given the company tremendous pricing power. Strong demand, and tight supply. And guess what? Pricing power. We expect this situation to continue at least in the first half of the year. The easing in the chip crisis will be more visible in the second half.

(To note that carefully, if the chip crisis decreases the number of units sold, of course, the process could turn into a bad direction for the company. Right now, it’s about pricing than volumes.)

We would like to draw attention to other features enabling the company to capitalize on all of these dynamics. First and foremost, it is a great advantage that the company is the sole authorized distributor for critical, well-known, high-quality-perception brands. In addition, its products appeal to many different consumer groups, from affordable ones to very luxury models. These models are also in high demand in the second-hand market and can be sold at high prices (especially VW models). This situation gained even more importance due to the high inflation. Evidently, according to the research about the online passenger cars (PC) and light commercial vehicles (LVC) second-hand sales market in Turkey, conducted by INDICATA, in 2022, VW became the market leader in the second-hand online sales market with 247,113 units (14% market share). (In addition, in the second-hand online sales market, the average sales price increase since the beginning of 2022 has been 43 percent.). Looking at the sales speed of the brands, the data confirms VW's market power. In December 2022, vehicles were sold in an average of 28 days in the second-hand online sales market, while VW models were sold in an average of 23 days, making it the fastest-selling brand. In addition to the sectoral dynamics, with such structural advantages explained above, the company had high revenues, profits, and profit margins in the recent period.

On the other hand, as we said above, the company also has different business lines such as a vehicle inspection unit. The company has a stake in TUVTURK, the vehicle inspection unit. TUVTURK is a monopoly in this field in the domestic market since 2007. The relevant contract expired at the end of 2027. According to the information we received from the company's annual activity report, periodic vehicle inspections of approximately 11 million 275 thousand vehicles were carried out in 2021, an increase of 9.9% compared to the previous year. This business line is quite important for the company because inspection fees increased around 123 percent as of the new year. It will contribute to the company’s financials quite positively in 2023.

What to Expect?

For the company’s future financials, we think that three important factors are prominent:

i) Chip Crisis:

If the chip crisis eases, and the availability increases, it will support revenues but be detrimental to the margins because more competition will increase the price competition. We are at the historical peak of the margins. Therefore, this situation has serious risks for all DOAS investors, and we can say that is the main reason for writing this post. If availability increases, DOAS cannot minimize low-cost buyers (no more seller’s market). Be careful and take the margin normalization into the consideration!

ii) Elections in Turkey:

After the election, what will be the exchange rates, and interest rates, and the outlook of consumer confidence will be very much important. High volatility in exchange rates makes pricing very difficult. In addition, sharp increases in exchange rates may affect sales negatively by causing a loss of purchasing power. If consumer confidence deteriorates, consumers may delay their demand until predictability is achieved. Interest rates will also be important in terms of both demand, and consumer sentiment. However, the share of the purchases made with the use of loans in the total sales of DOAS will be important.

iii) Transition to Electrical Vehicles:

In Turkey, the share of electric vehicles in the total is low right now, indicating a strong potential. The number of electric vehicles is increasing rapidly. There are also significant opportunities for DOAS in this transition. Popular electric vehicle models of brands such as Audi, VW, and Porsche can be an important source of income for the company. It is highly probable that new incentives will be issued to increase the use of electric vehicles. The attempt of DOAS to install electric charging stations for Porsche’s Taycan models (a well-known electric vehicle in Turkey’s premium segment) is important in that respect.

However, at this point, it will be very important how much share Turkey's domestic brand TOGG will have in the premium electric vehicle market. It is undeniable that TOGG will be incentivized specifically by the decision-makers.

Disclaimer:

The articles on this website are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.