The Effect of the Strong Minimum Wage Hike

Welcome to our new markets post. We left behind a tough week for stock market investors in Turkey. Despite all the volatility in the market, we will continue to focus on fundamental indicators here. Those who have been following us for a while know that we do not make detailed company valuations here or give buy/sell advice, even implicitly. We focus mostly on overlooked developments, important details, and aspects that may affect valuation, and sectoral trends. We plan to continue in this way in the markets section (we have some reasons to do so). When we refer to the companies, we try to map the data. Regardless of the valuation of companies, we say it is positive or negative for companies. Maybe the news is positive, but the company is overvalued/expensive. Maybe the company has other serious problems (cash flow, financing terms, etc.). These are different things. So, be careful and keep it in mind, please.

The Effect of the Strong Minimum Wage Hike

This week, we will look at the impact of the strong minimum wage hike on the sectors in Turkey. First of all, as you know, the net minimum wage has been increased to 8.507 TRY. This level means a 55 percent increase compared to the last July and a 100 percent increase compared to the last January. We tried to measure the impact of that increase on the companies’ margins. Our aim is to understand in which companies and sectors there will be pressure on the margins and which ones are more likely to face margin compression. It could be a way to look at the financial statements of the companies and analyze the personnel expenses. However, this would take a lot of time and not all companies share information in the same format, making the comparison difficult. In conclusion, to analyze the sectoral impact, we looked at the annual industry and service statistics published by Turkstat. After the sectoral outlook, those who wish can make further research about the specific companies. However, we think it is important to see the sectoral outlook. In the annual industry and service statistics, Turkstat publishes the number of enterprises, number of employees, personnel costs, turnover, production value, and value added at factor costs in each sector based on NACE Rev.2 codes. By dividing personnel costs to value added at factor costs (the main determinant of profit), we tried to understand how much of an impact rising personnel costs can have on margins. We think that this is the ratio that helps us to understand the impact. Let us share the table with you first, and then I would like to draw attention to a few points.

Source: Turkstat, Galata Chronicles’ Calculations

Source: European Commission

Expressions in parentheses here indicate NACE Rev.2 codes. Some of the sectors in the table are the main groups and some are sub-sectors. We selected certain sectors and sub-sectors using NACE codes. For your better understanding and convenience, we also share the table showing the codes of the main groups above. So, you can better understand and locate the categories.

We should emphasize the importance of identifying which company falls into which category. For example, apparel (C14) is a sub-field of the manufacturing industry, as it can be understood from its NACE code because it has the letter C at the beginning. Therefore, a non-manufacturing company that only retails apparel falls into the retail (G47) category, not the apparel (C14) category. The second table above will guide you in that respect.

Now, if we come to the results, we see that sectors such as leather manufacturers, retailers, apparel manufacturers, hospital services, furniture manufacturers, and construction are the sectors that are likely to feel pressures in their margins. However, this does not mean that companies will inevitably experience a decrease in their margins. It will be important which companies can overcome this pressure by using their pricing power. Therefore, demand conditions in these sectors, the other COGS and OpEx items, etc. will also be important. As we have emphasized in our previous articles, we think that retailers in general may be more resistant to this pressure due to the high demand of the end consumer. Because we think the other supporting factor for retailers is falling commodity prices (cotton for apparel retailers, for example). On the other hand, electricity, basic metals, and chemicals stand out as sectors that can be affected by a minimum wage hike less.

In the meantime, of course, the minimum wage hike will also have an impact on the demand side. For example, we can expect an increase in demand on the consumer discretionary side. We should note that we also expect this trend to differentiate regionally (regional discrepancy). To be clear, consumer discretionary demand in Istanbul may be weaker compared to other provinces, as the increase in prices and rents is strong in Istanbul comparatively.

In general, we like retailers as the investment theme, at least for the first half of 2023. Because steps are constantly being taken to keep end-consumer activity high (populist steps on the eve of the election). Demand conditions are good so far, which can be seen in the debit and credit card expenditure data. High demand increases the pricing power. We learn that retailers are not fully utilizing their discount budgets. On the other hand, the tight monetary policy applied in global markets keeps raw material costs down, which is positive for retailers. Moreover, at least for now, there is no problem on the USDTRY side. It is also important to note that retailers will not be affected too much by the slowdown in export markets either because their exports are comparatively quite low. However, the discussion of which and how much cheap such companies are in terms of valuation is a separate question that needs to be answered meticulously.

A Different Perspective on the Re-opening of China

Let's move on to another topic we want to look at this week. Everyone is discussing when the China re-opening will happen. This will be very important for global markets because it is clear that what happens in China does not stay in China, as William L. Barcelona et. al. argued.

When we consider the re-opening issue in terms of tourism and airlines, it will have important effects. As HSBC stated recently, the Asia region has the largest potential upside in that respect.

Source: HSBC

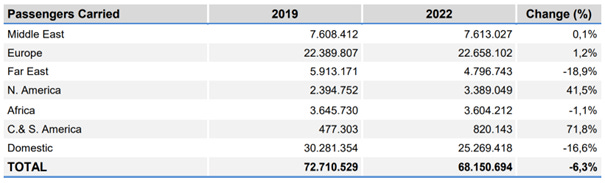

It will certainly have implications for Turkey as well. We think that this situation may be positive for Turkish Airlines (THYAO). When we look at THYAO's traffic data, there is a very positive picture compared to 2019 levels in all other regions, while the traffic in Asia (Far East) is comparatively far from 2019 levels. The tables below show THYAO's traffic data by region in 2019 and 2022.

Source: Company data, cumulative

The re-opening of China will strengthen THYAO's hand in maintaining and growing its sales. However, it will be important whether THYAO will have sufficient capacity to meet the demand in this region. It is stated that THY will increase its capacity by 17-20 percent in 2023. Under these circumstances, we welcome this situation.

Exceptional Exporter

Recently, we have had very negative words for textile manufacturers. Factors such as the slowdown in export markets, the effect of minimum wage hikes, almost flat exchange rates, rising PPI-based real effective exchange rates, falling capacity utilization rates, and layoffs were discussed a lot. However, we put YUNSA (Yünsa Yünlü Sanayi) aside. The company produces woolen woven fabric. In other words, it works in a high-value-added branch of the fabric industry. We estimate that this is the tailwind for the company's sales. Woolen woven fabric export data, which is the leading indicator for the company's sales, grew quite strongly YoY in November and December.

Source: Istanbul Textile and Raw Materials Exporters' Association (İTHİB)

Disclaimer:

The articles on this website are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.