Get Wind of Galata Wind!

Hello, everyone. Today, we want to introduce you to a company, named Galata Wind (GWIND), and try to estimate its third-quarter results, which will be announced in the coming days, or weeks. Our aim is to show that we can somehow predict the revenue dynamics of energy companies (that have licensed power plants only) before the announcement of financial reports. Get wind of Galata Wind!

General Info:

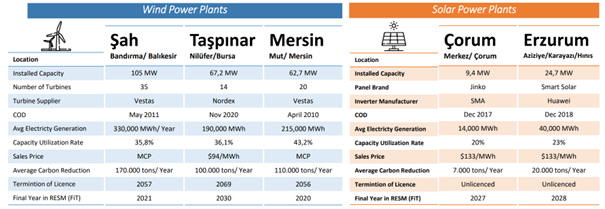

As a subsidiary of Dogan Holding since 2012, Galata Wind generates electricity using 100% renewable energy with its 3 wind power plants (WPP), and 2 solar power plants (SPP) and sells this electricity. In sum, the company has a 269 MW total installed capacity, and 234.9 MW of this belongs to WPPs and 34.1 MW to SPPs. While its WPPs are licensed, its SPPs are unlicensed (we will explain why this is important for our post). The company had its IPO on April 2021 with the ticker of GWIND.

From the company’s corporate presentation

In Turkey, renewable electricity generation is supported by some incentives under the name of YEKDEM (tariffs that guaranteed a fixed purchasing price). YEKDEM is the “Renewable Energy Resources Support Scheme” to incentivize renewable energy investments in Turkey. Mersin and Şah WPPs were removed from the scope of YEKDEM in 2020, and 2021 respectively. Mersin WPP and Şah WPP became operational in 2010, and 2011 respectively. Right now, these plants sell electricity based on market conditions, not at a fixed price. Taşpınar WPP and two SPPs sell electricity at a fixed price within the scope of YEKDEM.

Taşpınar WPP will be able to sell electricity at a price of $94/MWh in the first 5 years of YEKDEM because domestic equipment is used in its construction (then, will decrease to $73/MWh for another 5-year period). Taşpınar WPP became operational at full capacity at the end of March 2021. On the other hand, the fixed price for SPPs (Çorum & Erzurum) under YEKDEM is $133/MWh until 2027, and 2028 respectively.

From the company’s corporate presentation

Additionally, the company also operates in the field of rooftop solar projects, albeit it is a small share in total revenues. Moreover, the company sells carbon certificates on the voluntary carbon market that is granted due to the carbon emissions reduction coming from renewable energy generation.

Galata Wind is targeting to expand its total installed capacity to a total of 500-550 MW by 2025 year-end via capacity extension in its power plants, and new power plant acquisitions in Turkey and abroad. Its commitment is to invest in renewable energy plants only.

From the company’s corporate presentation

Electricity Generation and Revenue Estimate for 3rd Quarter:

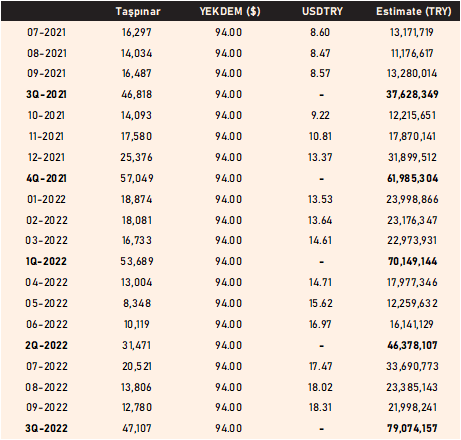

In that section, we will try to estimate the company’s third-quarter results, which will be announced in the coming days, or weeks. For licensed power plants, we can follow the generation data (plant-specific data) almost simultaneously on the EPİAŞ website. Galata Wind’s WPPs are licensed, while SPPs are not licensed. Therefore, we can multiply the generation data with the sales prices (YEKDEM price or market clearing price) and reach our revenue estimate coming from wind power plants. Attention! YEKDEM price is fixed, and it is easy to calculate for the relevant power plants (with an average USDTRY exchange rate). But all power plants (outside of YEKDEM) don’t have to sell their electricity at the market clearing price. Therefore, this is just an estimate. When the level of divergence between the market clearing price and the price in their bilateral agreements increases, our estimate will be getting more blurry. Moreover, since April 2022, there are different maximum settlement prices applied to the power plants based on their resource cost structure (natural gas, imported coal, domestic coal, renewables, etc.). Therefore, we should take these dynamics into the consideration. For the backtesting, I will use the data from the third quarter of last year to now (to be honest, there is a huge divergence before that period, probably because of large volumes of bilateral agreements that were priced differently).

Let’s begin.

The table below shows the generation of Galata Wind’s wind power plants (MWh):

Total generation from WPPs increased by 35% quarterly (not that much meaningful because of seasonality) and decreased by 2% annually.

For Mersin and Şah WPPs, we should use the market clearing price. We use the maximum settlement price for the months after March 2022.

For Taşpınar WPP, we should use YEKDEM price. USDTRY indicates the average exchange rate during the period.

Then, we can calculate the total revenue estimate coming from the wind power plants. “Actual” column indicates the reported revenue from WPPs.

There are two SPPs that sell its electricity through fixed YEKDEM price ($133/MWh). Based on the historical data, in the third quarter, two SPPs are likely to generate around 16.000 MWh. With an average USDTRY exchange rate (17.93), their contribution to the revenue is likely to reach 38 million TRY. Therefore, our estimate for the revenue from WPPs and SPPs is around 339 million TRY. If we roughly calculate the contribution of carbon certificate sales and add other items, we can say that Galata Wind’s revenue will be somewhere around 340-350 million TRY. We can't wait to see the actual results.

Thanks for your attention.

Credit Card & Debit Card Expenditure Data

As a routine, we will publish credit card & debit card expenditure data:

Petrol stations and accommodation maintain a strong stance. Insurance and telecommunication are getting stronger gradually. On the other hand, it is notable that electronics go down drastically.

See you in the next post!

Disclaimer:

The articles on this website are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.