Contextual and Structural Tailwinds: The Furniture Sector in Turkey

It has been longer than usual since we shared the last markets post. During the period, we published two macro posts on important developments. Welcome to our new markets post. Today, we will look at the furniture sector’s overall performance this year and its 2023 outlook. Furthermore, we will analyze the reasons why we think there are significant medium and long-term opportunities in the furniture sector in Turkey.

Let’s start with the latest situation and contextual tailwinds.

The furniture sector has an important place in the Turkish economy with its manufacturing capacity, employment level, exports, etc. The sector performs well this year despite all uncertainties and challenges. Furniture expenditures increased by 101% in the first 50 weeks of this year compared to the same period last year (according to the debit and credit card data, published by the CBRT). This growth is above the headline inflation (84.39%) and the sub-category of furniture inflation (%92.83). Right now, in Turkey, people consume in attainable areas in order to protect themselves against inflation. This situation creates traffic on the retail side, which is a clear tailwind for furniture retailers as well. We expect an increase in the shopping appetite in 2023 for durable consumer goods including furniture after the strong minimum wage hike, announced recently. Things seem to be going well in the domestic market despite the challenges.

For a while, the sector’s capacity utilization rate has been above the rate of the durable goods sector.

Source: CBRT

Let’s look at the exports side. While Turkey's total exports increased by 14% in dollar terms in the first 11 months of the year, furniture exports increased by 25%. It indicates that contrary to many other sectors that have problems due to the slowdown in economic activity abroad, Turkish furniture manufacturers maintain their relatively strong position in the export markets. It is exceptional. For example, having a similar cyclicality in terms of sensitivity to economic activity, the electrical and electronics sector has increased its exports by just 6.7% annually since the beginning of the year. Similar to the domestic market, there is a relatively positive scenario here.

On the costs side, as noted in the latest report of Garanti Securities (written by Emin Tay), the significant decrease in TDI prices (toluene diisocyanate, an important raw material for the sector) will also create a significant cost advantage in 2023 and is likely to help the margins. According to the industry and service statistics announced by Turkstat, the share of labor costs in the production value is 13.1% in the furniture sector. Considering a 55% increase in the minimum wage, we think its impact will be limited compared to the advantage coming from the decline in TDI prices.

If we look at contextual catalysts ahead of us, a possible mortgage package that government might announce towards the election, or the social housing project will certainly have a positive impact on the sales. Moreover, the house renewal projects (run by the Environment and Urban Ministry) or the possible increase in demand that may arise from the migrant/foreigner interest in Turkey (those who buy the house to obtain citizenship) have the effects. However, we cannot quantify their effects properly.

Currently, the housing supply in Turkey is not even remotely at a sufficient level. A normalization of costs in the construction industry seems likely in the coming years, and this might unleash an expansion in the housing supply, and this situation will be also positive for the sector.

To summarize, in addition to the possible catalysts ahead of us, the situation in the domestic and foreign markets is not bad despite various challenges.

In addition to these contextual dynamics, three structural/secular factors make us think that the future is bright for the sector.

1) Demographic Factors

We think that some demographic factors will keep the furniture demand relatively stable (risks are quite limited for too steep a decline). It means that these factors are likely to shield the sector from cyclicality to some extent (we do not say here that it will be as if there is no cyclicality, of course, there is and will be). What are these structural factors?

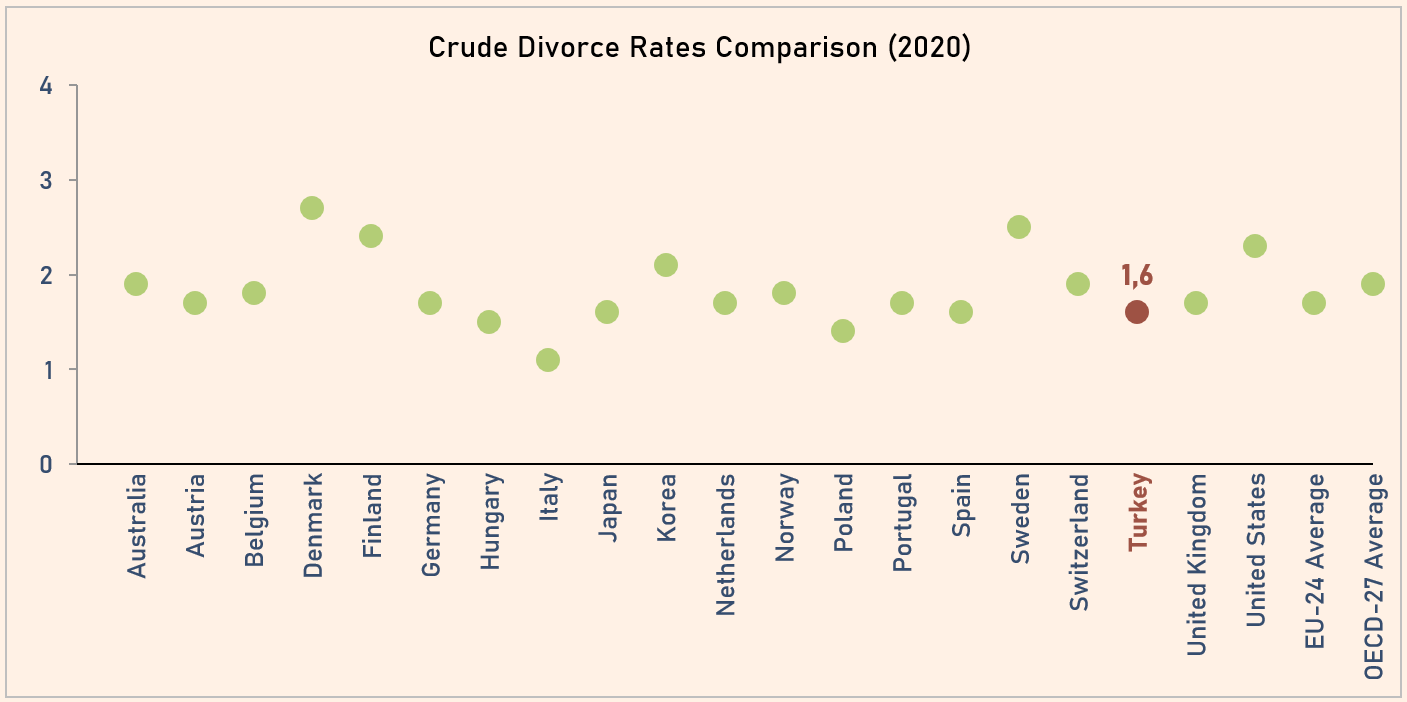

According to the data published by Turkstat, the number of marriages in 2021 was around 560 thousand in Turkey. The crude marriage rate, which represents the number of marriages per thousand people, was 6.68 in the same year. On the other hand, the number of divorces in 2021 was around 174 thousand. The crude divorce rate, which represents the number of divorces per thousand people, was 2.07 in 2021. To summarize, based on a 10-year average, around 700 thousand new households are formed every year in Turkey due to marriages and divorces. While Turkey’s crude divorce rate is around OECD and EU averages, the crude marriage rate is well above them. On the marriage side, we do not expect this dynamic to suddenly disappear in Turkey because of the factors such as the relatively higher young population ratio and religious/cultural favor towards marriage. Marriage is something that is encouraged in Turkey. According to 2019 OECD data, the male mean age at first marriage in Turkey was 28, while OECD and EU averages were around 33.

Source: Turkstat

Source: OECD

Source: Turkstat

Source: OECD

Let's put the marriage and divorce data aside. The average household size in Turkey is declining. The average household size in Turkey, which was 4.0 people in 2008, showed a steady decline and fell to 3.23 people in 2021. The ratio of single-person households consisting of individuals living alone, which was 7.9% in 2011, increased to 18.9% in 2021. The high rate of new household formation supports the furniture demand.

Source: Turkstat

We think that the aforementioned factors create fresh demand every year and keep the downside risks more limited.

2) Possible Consolidation

Compared to other sectors, the furniture sector is highly fragmented.

CBRT publishes the financial data of the sector by compiling the financial tables of individual real sector companies (by using individual data and aggregating them). In the 2021 dataset, there are nearly 1 million companies’ data.

In the dataset, the companies are divided into four main groups in terms of size (micro, small, medium, and large ones). Companies that employ more than 250 people and whose annual net sales revenue or financial balance sheet exceeds 25 million Turkish Lira fall into the “large” category. We compared the furniture sector with the manufacturing sector in general. According to the data, while the share of large companies in total net sales is 74,4% in the manufacturing sector, this share in net sales falls to 36,6% in the furniture sector (a total of 9101 furniture companies included, we think this is indicative). It is comparatively quite low. This share was 31% in 2018. Going to earlier years may not be very accurate by using this data due to some methodological differences.

Source: CBRT

Source: CBRT

Unbranded products are common in Turkey. We think that large companies with economies of scale, operating leverage, and that can afford high advertising expenditures can gain market share from small and unbranded product manufacturers in the upcoming years. Even when the market is not growing, this can have a relatively positive impact on sales for large companies.

We accept that the furniture industry is more open to fragmentation due to its characteristics, but we think that there is room for gradual consolidation. Since 2011 in the US, the share of furniture store business done by the Top 100 stores has grown from 62% of sales to around 85% in 2021. We think that a similar consolidation will take place gradually in Turkey (although probably will remain below manufacturing sector averages).

Therefore, we see this dynamic as an opportunity for big players (YATAS, or DGNMO amongst the publicly-traded ones, for example). Strong marketing efforts can help large companies build a loyal customer base and increase their market share. Moreover, they can seek out acquisitions. They can capture the recent dynamics and product trends in the sector earlier and increase their market share easier, compared to the small players.

On the other hand, in terms of profitability, it is promising. When we look at the profitability of the sector by size, we see an increase in profitability as the size increases.

Source: CBRT

3) Export Potential

Turkey can be an important opportunity for countries that want to diversify their furniture supply chain. It is known that some Western companies are interested in the furniture sector in Turkey. According to that source, ten furniture companies have opened a purchasing office in Istanbul.

In 2023, the sector’s export target is 10 billion dollars. The "distant countries strategy" supported by the Ministry of Commerce includes the goal of finding new markets for the furniture industry. In this direction, efforts will be made to expand operations in 18 countries such as the US, India, China, Canada, Mexico, South Africa, Australia, Nigeria, Brazil, etc. Currently, the share of neighboring countries such as Iraq and European countries such as Germany is higher in the sector's exports.

We think that with its location, manufacturing capacity, and abundant raw materials, Turkey has the potential to expand its operations abroad in that sector.

All in all, in addition to the current momentum and possible catalysts ahead of us, we think that there are medium and long-term tailwinds.

Lastly;

Now let's talk about two publicly traded companies in the furniture sector briefly (very brief overview in order to introduce them).

YATAS: The Kayseri-based company has an important position in the sector. The company operates in different segments with different brands (Yataş, Enza Home, Divanev, Puffy) and successfully targets different customer groups.

The company's revenue increased by 142% on an annual basis in the first 9 months of the year. Operating profit increased by 158% and net profit increased by 149%.

The company has steadily grown its sales area and number of stores in recent years, which is positive. The company is the second largest company in the country in terms of the number of stores. We also think that Yataş's brand perception is good in the eyes of consumers. We think that the company's ability to quickly identify consumer needs (such as the popularization of modular furniture) is an important factor in that success.

However, the company's margins have been under pressure recently. The process of reflecting costs on prices might be delayed. The decrease in TDI prices may have a positive effect in this respect.

In addition, we should point out that the company is far from the targets it has set for many years on the export side (currently around 10 percent). On the other hand, the share of online sales in revenues is still low (currently around 5 percent).

We think that the most important agenda items (in addition to macro and sectoral developments) for the company in the coming period are the course of raw material costs, the improvement of pricing ability and stabilization of margins, sales area and store growth, and export and online sales growth.

The company is currently trading at 10.8x P/E and 4.1x P/BV. The company's PEG ratio is at 0.09.

DGNMO: Doğan Furniture is a subsidiary of Doğanlar Holding. The company has five brands (Doğtaş, Kelebek, Lova, Ruumstore, Kelebek Kitchen&Bathroom). The company ranks third in the country in terms of the number of stores.

The company's revenue increased by 111% on an annual basis in the first 9 months of the year. Operating profit increased by 120% and net profit by 174%.

Especially after 2018, with the change in its senior management, the company has strongly increased the number of stores, significantly reduced its indebtedness, and increased its margins. In addition, the company has strong growth targets in segments such as beds, kitchen&bathroom furniture. According to the information we received from the sector, these products have a higher gross profit margin compared to other furniture products. On the other hand, the company has projects on the installation and optimization of logistics warehouses. This situation is likely to increase the optimization level and create a cost advantage. However, the margins follow a fluctuating course for a while. Margins are likely to stabilize as current investments mature.

The company is currently trading at 26.1x P/E and 9.0x P/BV. The company's PEG ratio is 0.50.

Thanks, everyone, and see you in the next post!

Disclaimer:

The articles on this website are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.