By Far, The Best Investment of This Year

Hello, everyone.

We will announce the best investment of this year, by far. It is Borsa Istanbul. Surprisingly, yes. The word “Turkey” is generally mentioned in the discussions about its monetary policy decisions in global markets. However, this time, Turkey should have attracted the attention with its stock market performance. The return of benchmark index (XU100) exceeded 60 percent in dollar terms year-to-date (from the close of the last trading day of 2021). Given the current performance of other stock markets, undoubtedly, Borsa Istanbul provides a good opportunity for both residents and foreigners. We left October behind, and a bunch of important data was released this week. In this piece, I want to make a quick overview on some of them.

A General Note

When we refer to the companies, we try to map the data. Regardless of the valuation of companies, we say it is positive or negative for companies. Maybe the news is positive but the company is overvalued/expensive. Maybe the company has other serious problems (cash flow, financing terms, etc.). These are different things. Keep in mind, please.

Sectoral Export Data

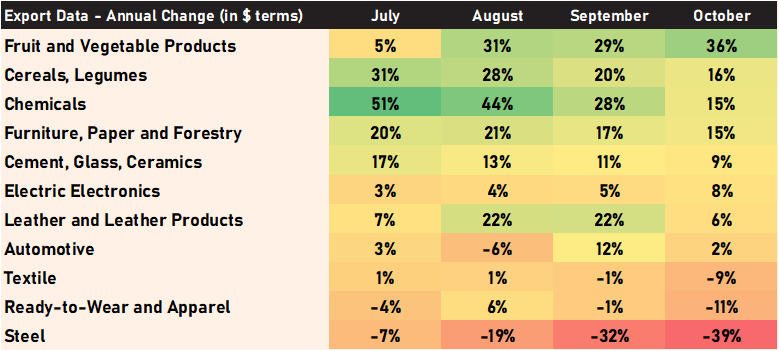

Turkish Exporters Assembly (TİM) has published the export data for October. We select most relevant categories to see the evolution of exports in key sectors.

In October, fruit and vegetable products gained further positive momentum YoY. Canned products contributed to headline growth the most (+76% YoY), which is positive for canned product producers such as tomato paste companies. These companies that sell essential goods attracted investors’ attention amidst current inflationary and recessionary environment. Evidently, cereal category also posted a strong growth. In this category, the vegetable oils affected the growth the most (+41% YoY).

This year, traditionally-strong sectors (having larger shares in Turkey’s exports) such as textile, apparel, automotive, steel have experienced significant fluctuations because of cyclicality. However, chemicals have posted strong growth. On the other hand, furniture, paper, and forestry sector stand relatively strong, and increased its export 15% YoY. If we look at the sub-categories, compared to furniture, the paper and cardboard segment has grown stronger.

The danger bells are ringing for steel, ready-to-wear, and textile sectors, at least in the export market.

Debit & Credit Card Expenditure Data

CBRT published the debit & credit card expenditure data for the week ended 28th October.

Insurance, petrol stations, markets, and restaurants stayed strong as past weeks indicate. It is notable that the electric & electronics expenditures got stronger, which is a bit unexpected given that the appetite for durable goods seems low at that stage. We should closely watch whether it is temporary or not.

Türk Traktör (TTRAK) Sales Data

Türk Traktör (TTRAK), the largest tractor producer in Turkey, announces its sale data monthly. Türk Traktör have 50 thousand tractor production capacity in a year. According to October sales data, the overall volume decreased by 2%. While export volume increased by 13%, domestic volume decreased by 10%. Therefore, if the volume is shrinking, the pricing will be very important.

We think that Türk Traktör can benefit from the current dynamics in Turkey. These are:

i) The future of agricultural production seems promising for farmers in the country. The main driver for farmers when deciding to produce more is what the sale prices level will be next year and the demand outlook. Right now, for farmers, we think that positive momentum is ahead.

ii) The subsidy for domestic tractors will continue until the end of 2023. Under the scope of that program, the interest rate is 5.6% right now (do you know the CPI in Turkey?).

To conclude, in this inflationary environment, the attractive loan standards, and farmers’ appetite for more production can support tractor market. Farmers are likely to renew its old tractors in that environment. As company stated in its investor presentation, in Turkey, 48% of all tractors aged above 24 years. If not now, then, when?

Of course, there are risks. Our concern is that we do not know how much Türk Traktör capitalize these trends even if it is market leader. Because:

i) We do not know the price levels of all different companies. If Türk Traktör’s pricing is relatively expensive, maybe it can hinder the growth. Small companies can come to the fore. Even if farmers have positive outlook, they can prefer less expensive models to make saving due to the high level of uncertainty.

ii) The management of supply chain is critical. The supply of key materials (chips or something like that) can differentiate the performance of companies.

iii) As you realize, for now, the data does not confirm our predictions. The data should be closely watched.

Woven Fabric Export Data

Istanbul Textile and Raw Materials Exporters' Association (İTHİB) published woven fabric export data for October. The table below shows the total woolen woven fabric export of Turkey. Accordingly, Turkey’s woolen woven fabric export increased by 29% in dollar terms on an annual basis in October. This is a positive signal for YUNSA (even if it loses YoY growth momentum). The company makes a significant part of this export.

Disclaimer:

The articles on this website are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.